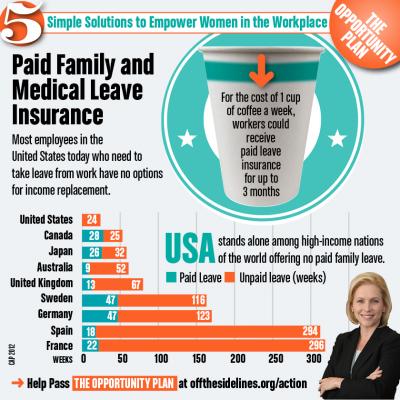

For a summary, see our prior Benefit Beat article here.Įffective January 1, 2022, the premium rate for PFML will increase to 0.6% (from 0.4% in 2021) of each employee’s gross wages up to the Social Security cap of $147,0 ($142,8).Įmployers with 50 or more employees working in the state of Washington will pay 26.78% of the 0.6% premium and employees will pay 73.22%. The PFML law provides up to 12 weeks of medical or family leave for one’s own illness, baby bonding, to care for a family member, or military exigency.

#Paid family leave washington professional#

Professional Services | National Practice.Private Client Services | National Practice.Manufacturing & Distribution | National Practice.

Commercial Real Estate | National Practice.Banking & Financial Services | National Practice.Private Client Services for Insurance & HR.Defined Contribution Administration Services.Defined Benefit Administration Services.Private Client Services for Accounting & Tax.Insurance Appraisals & Tangible Asset Valuation.Cybersecurity & Privacy Resource Library.Litigation Support, Economic Damages & Expert Testimony.COVID-19 Loan & Capital Assistance Services.Accounting, Bookkeeping and Business Process Outsourcing.Private Client Tax & Accounting Services.Frequently Asked Questions About Cost Segregation.Section 382: Use of Net Operating Losses.Exempt employees from Washington Paid Family and Medical LeaveĬheck with your state if you're exempt from this tax. If you have already run paychecks this year before setting up this rate, the employee will have any catch-up amounts deducted from their next paycheck. Next to Enter the number that identifies you to the agency window enter your EIN. Select Next until you get to the Agency for company-paid liability window.Double-click the payroll item called WA – Paid Fam Med Leave Emp or WA – Paid Fam Med Leave Co.If you aren’t sure what your account number is, look it up with the Washington State Department of Revenue.

#Paid family leave washington install#

Download and install the latest payroll update payroll update.

0 kommentar(er)

0 kommentar(er)